How do we invest and work with a digital mindset?

Whilst the opportunities for digital solutions to boost financial inclusion are vast, at Abler Nordic we believe it’s crucial that technology is balanced with human relationships

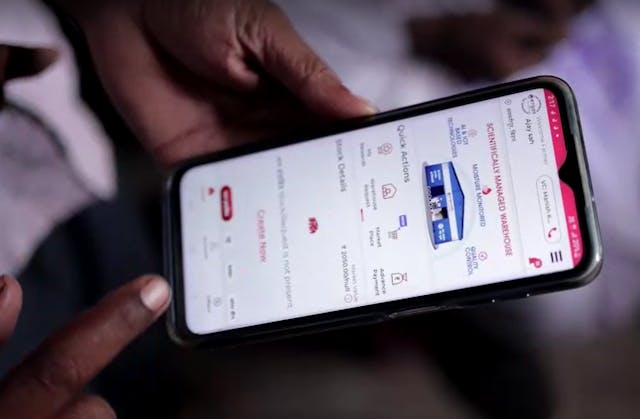

In recent years, the availability and uptake of digital financial services has become an important enabler of financial inclusion in rural areas—aided by increasing mobile penetration—to connect people to financial services they otherwise may have difficulty accessing.

Digital access breaking down barriers

In the last decade, 1.2 billion previously unbanked adults gained access to financial services and the unbanked population fell by 35%, in no small part boosted by the increase in mobile money accounts.

In Sub-Saharan Africa, smartphone adoption was at 51% in 2022, but projected to rise to 87% by 2030.

Mobile penetration has paved the way for reaching and empowering customers with quality digital financial services and helping them start and grow their businesses. Digital payment services may enable a micro entrepreneur to receive payments digitally, reducing the risk of cash handling. A digital marketplace may be used by micro entrepreneurs to market and sell their products and services, reaching beyond their traditional market.

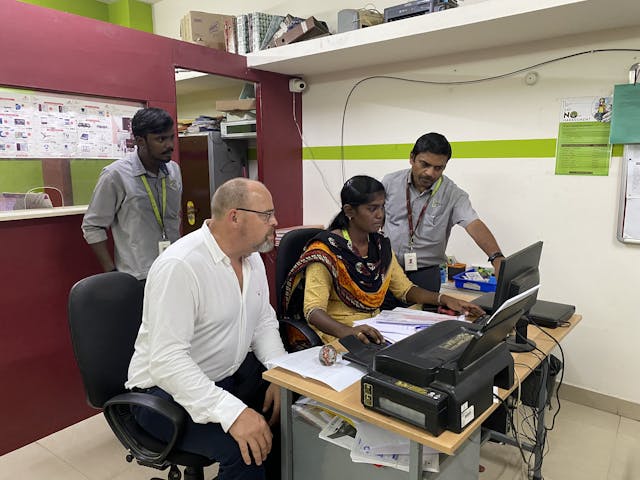

While the opportunities are vast, at Abler Nordic we believe it’s crucial that technology is balanced with human relationships to engage, support and educate. A key barrier to reaching full financial inclusion has traditionally been low digital and financial literacy levels; as access to digital services increase, it’s critical that literacy in both areas keeps pace.

"The key here is to make the digital transition useful and efficient, without losing the magic of the human relationship,”

| Steinar Sæther, Digital Transformation Officer, Abler Nordic

Investing with a digital mindset

Used judiciously, we believe technology can help deliver better quality and more useful products to customers, reduce operating expenses, and increase profitability, enabling the company to reach more people – and ultimately reducing costs for customers.

“There are great opportunities in this sector for good digital financial services, to reach more clients, serve them with better quality and be more efficient,” says Steinar. “The financial institutions themselves will also be more robust, they don’t tie up a lot of assets in brick and mortar.”

As an active owner, Abler Nordic works closely with each of the companies we are invested in to help shape and implement relevant and realistic digital strategies that consider their whole digital eco-system.

A value creation plan with a clear digital focus is developed for each investment at the start of the investment period, with expert guidance from our Digital Transformation Officer Steinar Sæther and project resources provided through our Technical Assistance facility, funded by Norad.

Improving an institution’s overall digital infrastructure is crucial for increasing efficiency and reducing cost, and is often the foundation for developing solid customer-facing digital services that work as intended.

One example is supporting investees to better analyze the vast amounts of customer information in their core banking systems, to gain insights that can both reduce credit risk and improve operational efficiency. By creating profiles on customer types, they can add a dimension to their credit scoring solutions, and by analyzing customer performance in the context of global parameters— for example, local weather conditions, market price, etc.—they can stress-test their portfolio.

“Digitizing every step of the entire process is bringing in more efficiency in the turn-around time, in the quality of the product we are providing and customer engagement. We are seeing a lot of efficiencies that will come in. Are we there yet? No—but we are on the path,” says Smriti Chandra, Investment Director and India lead.

Strong customer relationships are crucial

“One of the keys to success in traditional microfinance has been the relationship between the customer and the loan officer. The loan officer is there not just to facilitate transactions, but to spread knowledge and support the customer to make good financial and business decisions,” says Steinar Sæther, Digital Transformation Officer at Abler Nordic.

“Depending on how digitally and financially mature the customer is, financial awareness education can be delivered through a combination of physical meetings with their loan officer and then graduated to partially digital means such as customer apps and communication channels such as WhatsApp.

"Digital tools are also important in making the loan officer’s work more productive and less cumbersome – freeing up their time to focus on their customers’ needs. The key here is to make the digital transition useful and efficient, without losing the magic of the human relationship.”

Check out some of our digital case studies:

Tackling distance with digital agents | Dvara KGFS, India

Technology supporting rural entrepreneurs | Juhudi Kilimo, Kenya